Paul, A Calendar Year Single Taxpayer, Has The Following Information For 2024 – Internal Revenue Service (IRS) responsibilities include assisting US taxpayers, conducting audits, verifying tax . Understand how to pay your 3rd instalment of Advance Tax for the Assessment Year 2024-25 before the deadline on 15th December. Detailed guidelines and a practical example provided. .

Paul, A Calendar Year Single Taxpayer, Has The Following Information For 2024

Source : www.facebook.com

US Home Price Growth Expected to Slow in 2024, Goldman Economists

Source : www.bloomberg.com

The 2024 Definitive Guide to the Arizona Charitable Tax Credit

Source : phoenixchildrensfoundation.org

Modi Likely to Keep India Rice Export Ban to Election, Keeping

Source : www.bloomberg.com

Waiting for Shohei: MLB free agent market slow as Ohtani mulls big

Source : www.kxan.com

German Budget: Government Gets €5 Billion Extra Leeway Bloomberg

Source : www.bloomberg.com

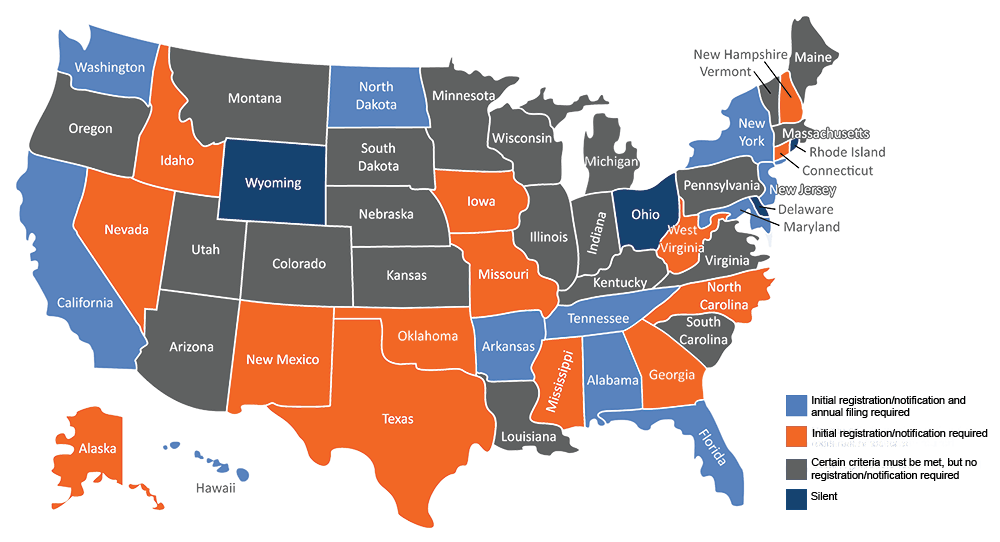

State Regulations

Source : www.acga-web.org

The Case for Two Fed Rate Cuts in Early 2024 Is Building Bloomberg

Source : www.bloomberg.com

Powell County Tourism Commission Natural Bridge/Red River Gorge

Source : www.facebook.com

Make Room for Minicars, the Electric Vehicles Cities Need Bloomberg

Source : www.bloomberg.com

Paul, A Calendar Year Single Taxpayer, Has The Following Information For 2024 Saint Paul Councilmember Amy Brendmoen, Ward 5: This form should be filed if the TDS/TCS for the month of November 2023 has been paid without the third instalment of advance tax for the assessment year 2024-25 is also due on this date. . Income tax rules say that if an individual’s estimated tax liability for the financial year after subtracting tax deducted at source (TDS) is over Rs 10,000 then advance tax has to be paid. If this is .